What Are the Different Types of Businesses?

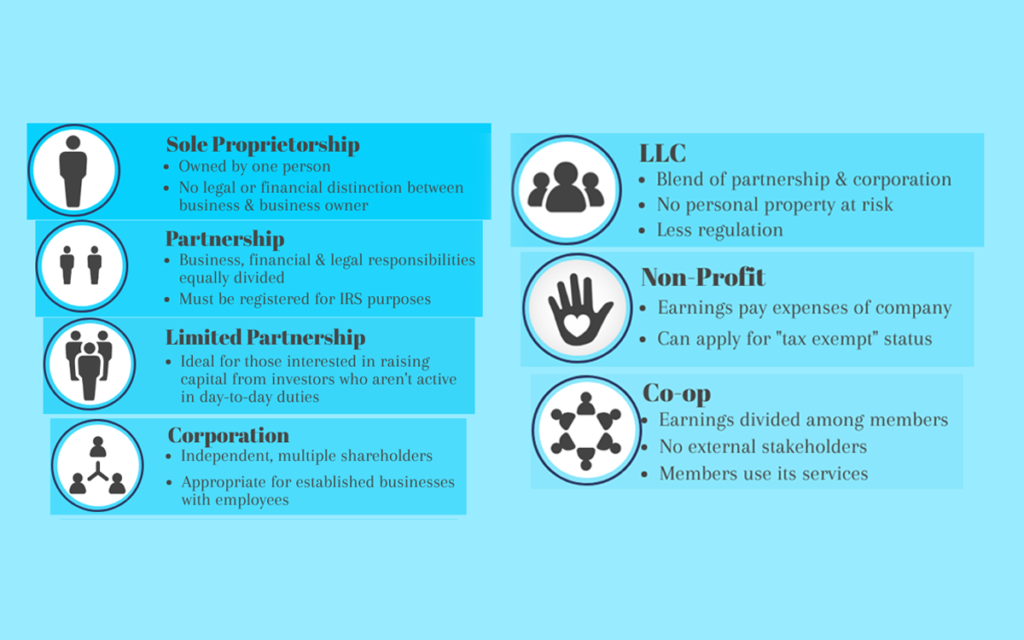

There are various types of businesses to choose from when forming a company, each with its own legal structure and criteria. The four main types of businesses are sole proprietorships, partnerships, limited liability companies (LLCs), and corporations.

Before beginning a business, entrepreneurs should carefully consider which kind of company structure is best for them. This article will provide a brief overview of the four primary types of businesses to aid entrepreneurs in making one of their most important decisions.

1. A sole proprietorship is a business owned and run by a single individual.

A sole proprietorship is a business that is not incorporated and is owned by just one person. While it is the simplest of the business types, it also offers the least financial and legal protection to the owner. Unlike partnerships or corporations, sole proprietorships do not create a separate legal personality for the business.

In essence, the company’s owner is the same person as the company. As a consequence, the company’s responsibilities are solely the responsibility of the owner. This is the route to adopt if an entrepreneur wants total control over their company. Furthermore, starting a single proprietorship is a very quick and inexpensive operation.

There are tax benefits as well since the money is taxed only once because it is considered the owner’s personal income. Finally, there are few restrictions that apply to single proprietorships.

2. Collaboration

As the name indicates, a partnership is a business owned by two or more people known as partners. Flow-through taxes may benefit partnerships, just as they may benefit sole proprietorships. Because the income is regarded to be the income of the owners, it is only taxed once.

The proprietors of a partnership are responsible for the firm’s obligations. However, there are certain exceptions. The three types of partnerships are general partnerships, limited partnerships, and limited liability partnerships.

- General Partnerships: This is the most straightforward kind of partnership to set up and operate, with low recurring costs. Every partner is considered a participant in the business’s operations, with unrestricted accountability.

- This means that each partner’s personal assets may be used to repay the partnership’s debts. This also suggests that each spouse is responsible for their partner’s actions. For example, John and Dave are in a general partnership. If John is sued for malpractice, a claim against Dave’s personal assets might be made.

- Limited Partnerships: This kind of partnership has at least one general partner. This general partner is in control of the company’s operations and accepts limitless responsibility for the partnership.

- Limited partnerships, on the other hand, have a smaller number of participants. Limited partners are completely responsible for the amount of money they put into the firm. Limited partners, on the other hand, do not participate in management decisions and have no direct control over the company.

- Limited Liability Partnerships (LLPs) are similar to general partnerships in that several participants share responsibility for the management of the company. LLP partners, on the other hand, are not personally accountable for the actions of their fellow partners or the liabilities of the company.

- Unfortunately, not all businesses can create an LLP. Attorneys and accountants, for example, are often prohibited from participating in this kind of company. Partnerships, in general, provide greater flexibility than other types of businesses, but they also come with a higher level of risk.

- L.L.C. (Limited Liability Corporation) is the third option (LLC) Limited liability companies (LLCs) are one of the most flexible business forms. A limited liability company (LLC) is a cross between a partnership and a corporation. They keep the benefits of sole proprietorships in terms of taxes while retaining the limited liability of corporations.

- LLCs may choose from a variety of tax treatment alternatives. As long as the LLC chooses not to be recognized as a C corporation, it retains its flow-through taxation status. Limited-liability companies (LLCs) also have the benefit of limited liability. The company is considered as a distinct legal entity under an LLC. This protects LLC owners from being held personally liable for the conduct and liabilities of the firm.

3. Corporation

Corporations, which are separate legal entities, are formed by shareholders. The act of forming a corporation protects its owners from personal accountability for the company’s debts and legal issues. Forming a corporation is more complicated than the other three types of businesses. The articles of incorporation must state the number of shares to be issued, the firm’s name and location, and the business’s objective.

A sole proprietorship or partnership is dissolved when one of the owners dies or declares bankruptcy. Corporations are self-contained legal entities. As a consequence, they are secure from this situation and will survive even if the firm’s owner dies.

Corporations are classified into three groups:

- A C corporation is the most common kind of business. The firm is treated as a business, and the profits are allocated to the owners, who are then taxed separately.

- S Corporation: An S Corporation is similar to a C Corporation, except it is limited to 100 stockholders. Because S corporations are pass-through organizations like partnerships, profits are not taxed twice.

- Non-Profit Corporation: Non-profit corporations are tax-exempt and often used by charitable organizations. To pay the company’s operations or long-term objectives, all sources of incoming cash flow must be exploited.

Are you thinking of starting a business? The Corporate Finance Institute’s corporate strategy course provides tactics and concepts for running a successful business!

Examples of Different Business Types

Many businesses begin as sole proprietorships since this is an excellent method for new, small businesses to get started. As businesses grow and expand, many of them become corporations. eBay is a well-known example of a sole proprietorship that eventually evolved into a corporation. Hewlett-Packard (HP) is an example of a well-known and very successful cooperation.

As their company grew, they, like eBay, eventually incorporated in 1947. On the other hand, the company began as a business partnership between two friends. Chrysler is a well-known automobile manufacturer in the United States.

Since its inception, Chrysler has operated as a limited-liability corporation (LLC) (LLC). Finally, one of the most well-known firms is Apple. Apple, often known as Apple Inc., was established immediately after the company began operations, similar to other major firms listed on stock exchanges. Apple is still one of the most powerful businesses on the planet. Despite the death of one of its co-founders, Steve Jobs, it has survived.